35. Kardashian-Jenner Family - $2 Billion

The Kardashian-Jenner fortune stems from reality-TV fame converted into direct-to-consumer brands and licensing. Kim Kardashian’s Skims moved beyond shapewear into a dedicated menswear line in October 2023, promoted with athlete campaigns and limited drops. Kylie Jenner monetized cosmetics by selling 51% of Kylie Cosmetics to Coty for $600 million in 2020, formalizing global distribution while remaining the brand’s face. Kendall Jenner expanded family income into beverages with 818 Tequila, launched in 2021 and rapidly scaled in U.S. retail.

While individual fortunes fluctuate with valuations, the family’s business machine emphasizes branding, limited-drop product strategy, and control over distribution and image through massive online reach and data-driven merchandising. The family continues to leverage endorsements, media production, and social commerce to sustain brand demand.

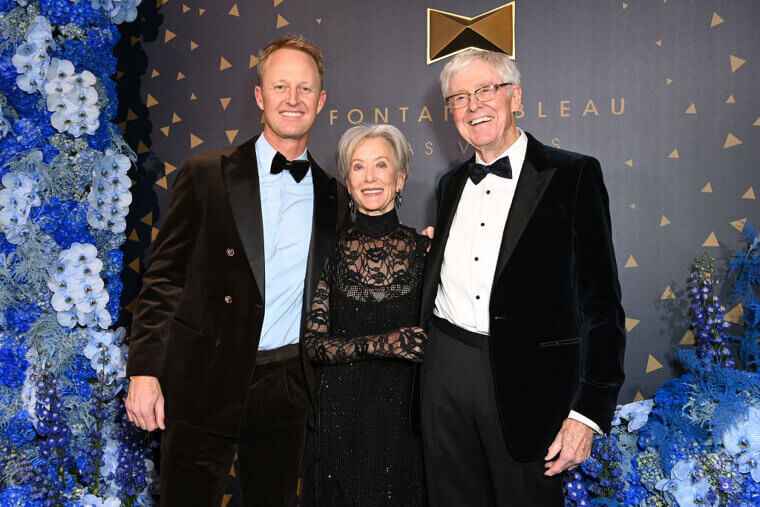

34. Wynn Family – $3.1 Billion

The Wynn family’s wealth originates with Steve Wynn’s reinvention of the Las Vegas Strip via The Mirage (opened 1989) and the Bellagio (opened 1998), properties that set the template for modern megaresorts. Wynn Resorts later developed Wynn and Encore Las Vegas and major integrated resorts in Macau combining gaming, luxury retail, dining, and entertainment. Corporate ownership evolved: by 2024, Landry’s owner Tilman Fertitta had become Wynn Resorts’ largest individual shareholder, overtaking cofounder Elaine Wynn.

The family’s profile also encompasses philanthropy and art collecting, alongside cyclical exposure to global travel and premium gaming trends.

33. Spielberg Family – $3.7 Billion

The Spielberg fortune centers on Steven Spielberg’s multidecade run of directing and producing global hits—Jaws, E.T., Jurassic Park, and Schindler’s List—paired with ownership participation through Amblin. Amblin Partners signed a 2021 multi-year pact to supply multiple feature films annually to Netflix, while also maintaining a refreshed multi-year partnership with Universal for theatrical projects—diversifying cash flows across platforms. Spielberg founded the Survivors of the Shoah Visual History Foundation in 1994 (now the USC Shoah Foundation), underscoring the family’s philanthropic focus on education and historical testimony.

While earnings vary with release calendars, evergreen library titles, participation rights, and franchise revivals help sustain cash flows across cycles and recurring international distribution revenues.

32. Cuban Family – $4.3 Billion

Mark Cuban’s wealth scaled after selling Broadcast.com to Yahoo in 1999 for approximately $5.7 billion in stock, then expanding into sports, media, and technology. He became widely known as owner of the NBA’s Dallas Mavericks; in 2023 he sold a controlling stake to the Adelson and Dumont families, with the NBA noting he retained significant influence over basketball operations at the time of approval.

Cuban also co-founded Mark Cuban Cost Plus Drug Company, launching its online pharmacy in January 2022 to sell generics with a transparent “cost plus” model, later studied for potential consumer savings.

31. Getty Family – $5.4 Billion

Oil magnate J. Paul Getty built the foundation of the Getty fortune, later endowing the J. Paul Getty Trust and Museum—among the world’s most richly funded arts institutions supporting conservation, research, and public collections. Family enterprises diversified over generations, including Getty Images, co-founded in 1995 by Mark Getty and Jonathan Klein, which grew via acquisitions into a leading stock-media company. The family’s history also includes the 1973 kidnapping of John Paul Getty III.

The artistic legacy and institutional endowment anchor the dynasty’s global profile and ongoing cultural influence alongside diversified family offices.

30. Kraft Family – $6.6 Billion

Robert Kraft’s family empire, the Kraft Group, spans paper and packaging, sports, real estate, and venture holdings. Core assets include International Forest Products—one of the world’s largest traders of forest-products commodities—plus the New England Patriots, New England Revolution, and Gillette Stadium in Foxborough. In 2025, a minority-stake sale valued the Patriots at roughly $9 billion while the Krafts retained control, underscoring football’s outsized role in the portfolio.

The Group’s paper, packaging, and logistics operations remain significant alongside venue management and media rights, reflecting a deliberately diversified, privately held structure built for durable cash flow.

29. Cathy Family (Chick-Fil-A Dynasty) – $11 Billion

The Cathy fortune stems from Chick-fil-A, founded by S. Truett Cathy and guided today by third-generation CEO Andrew Truett Cathy. The chain maintains its long-standing practice of closing on Sundays and runs a distinctive owner-operator franchise model with rigorous selection. As of 2025, Chick-fil-A reports more than 3,000 restaurants across the U.S., Canada, and Puerto Rico, with international expansion beginning in the United Kingdom and Singapore.

The privately held, family-controlled company emphasizes service culture, high average unit volumes, and disciplined, selective growth in fast-casual competition, supported by robust training and franchisee support systems.

28. Mellon Family – $12 Billion

The Mellon dynasty emerged from banking and finance led by Andrew W. Mellon, U.S. Treasury Secretary from 1921 to 1932 and founder of Washington’s National Gallery of Art. Family banking began with T. Mellon & Sons and evolved through Mellon Financial’s 2007 merger with The Bank of New York to form BNY Mellon, a custodian and asset-services firm. Philanthropy and education also loom large.

The Mellons helped create Carnegie Mellon University through the 1967 merger of Carnegie Tech and the Mellon Institute. Early stakes in Gulf Oil and Alcoa anchored the family’s influence in American industry.

27. Brown Family (Jack Daniel's Dynasty) – $12.3 Billion

The Brown family controls Brown-Forman, founded in 1870 by George Garvin Brown and now among the world’s largest spirits producers—owner of Jack Daniel’s, Woodford Reserve, Old Forester, Herradura, and more. The company is publicly traded yet remains family-controlled through super-voting shares, with the Browns maintaining majority voting power and multi-generation board involvement. Independent estimates place the family’s economic ownership around half the company.

Durable portfolios, premiumization, and global distribution underpin recurring cash flows, while brand stewardship and long time-horizons support investment in sustainability, barrel inventory, and measured growth in international markets.

26. Busch Family (Budweiser Dynasty) – $13.4 Billion

The Busch lineage built Anheuser-Busch into America’s dominant brewer before selling to InBev in 2008, creating Anheuser-Busch InBev—the world’s largest beer company—and ending direct family control. August Busch IV served as the last family CEO prior to the takeover. The dynasty remains a cultural presence in St. Louis, including stewardship of Grant’s Farm, which Busch descendants own and operate as a public attraction.

Longstanding ties such as Busch Stadium’s naming rights reflect the brand’s civic imprint, even as Budweiser and related labels operate within AB InBev’s global portfolio and marketing machine.

25. Du Pont Family – $14.3 Billion

The du Pont dynasty began in 1802 with Éleuthère Irénée du Pont’s gunpowder mill on the Brandywine, later evolving into a chemicals powerhouse behind inventions like nylon, Kevlar, and Teflon. Family fortunes diversified through the 2017 Dow–DuPont merger and subsequent spin-offs, including Corteva in agriculture and a reconfigured DuPont focused on materials and electronics. Beyond industry, the family shaped Delaware through philanthropy and landmarks such as Longwood Gardens and Nemours Estate.

Today, multigenerational family offices manage holdings across public equities, specialty materials, and impact causes, reflecting two centuries of engineering-led wealth creation and civic patronage.

24. Dorrance Family (Campbell’s Soup Dynasty) – $15 Billion

Wealth traces to Arthur C. Dorrance and his nephew John T. Dorrance, who perfected condensed soup at Campbell in the early 1900s. Descendants remain the company’s most influential shareholders through trusts and family members on the registry, while Campbell’s portfolio stretches beyond soup into snacks and meals. The family’s best-known modern figure is Mary Alice Dorrance Malone, an equestrian and the company’s largest individual shareholder. Family philanthropy spans education, the arts, and land conservation.

Despite shifting consumer tastes, the dynasty’s fortune continues to hinge on branded pantry staples, disciplined capital allocation, and recurring grocery-channel demand.

23. Hunt Family – $16.6 Billion

Texas oil wildcatter H. L. Hunt parlayed early East Texas discoveries into a clan whose branches span energy, real estate, and sports. Hunt Consolidated and Hunt Oil remained core engines under Ray L. Hunt, with additional businesses in infrastructure and private equity. The late Lamar Hunt founded the American Football League and the Kansas City Chiefs; his children continue ownership of the Chiefs as well as Major League Soccer’s FC Dallas.

Family influence threads through Dallas–Fort Worth civic life, with philanthropic commitments to education and healthcare complementing long-horizon, privately held investments in exploration, pipelines, and master-planned development.

22. Murdoch Family – $17.9 Billion

The Murdoch fortune centers on media holdings controlled via the family trust. Rupert Murdoch built a global empire spanning newspapers, television, and film; family assets split in 2019 when Disney acquired 21st Century Fox’s studio and entertainment assets, leaving Fox Corporation and a restructured News Corp. Lachlan Murdoch now leads Fox Corporation and serves as key figure in the family’s governance.

The trust retains controlling voting power, anchoring influence over news and sports broadcasting in the U.S., U.K., and Australia. Diversification includes book publishing at HarperCollins and stakes in pay TV and digital information services.

21. Bren Family – $18 Billion

The Bren family fortune is led by Donald Bren, chairman and principal owner of the Irvine Company, one of America’s most prominent private real estate firms. The portfolio dominates premium locations in coastal Southern California, including master-planned communities, office campuses, retail centers, apartments, and resort properties. Long-term, low-leverage development and strict design standards have generated resilient cash flow across cycles. The family’s civic footprint includes parks, open-space conservation, and educational philanthropy in Orange County.

With patient capital and vertical control over planning, leasing, and amenities, the dynasty’s wealth is closely tied to Southern California’s land economics.

20. Marshall Family – $18.5 Billion

The Marshall family wealth stems from oil investor J. Howard Marshall II, whose early stake in Koch Industries became a multigenerational fortune. Following estate litigation, the controlling shares flowed primarily to his son E. Pierce Marshall, with subsequent stewardship by heirs through trusts and family investment vehicles. Today, the dynasty’s wealth is closely linked to private ownership in Koch Industries—spanning refining, chemicals, commodities, and industrial technology—supplemented by diversified portfolios in energy and manufacturing.

The family maintains a characteristically low profile, emphasizing privacy, philanthropy, and patient, cash-generating holdings rather than high-visibility consumer brands or public-company roles.

19. Newhouse Family – $18.5 Billion

Samuel I. Newhouse Sr. founded Advance Publications, later expanded by sons Samuel Jr. and Si Newhouse into a media conglomerate spanning newspapers, magazines, and cable assets. The family remains behind Condé Nast (Vogue, The New Yorker, Wired) and holds significant investments in digital media and venture stakes. Advance also owns American City Business Journals and has long held minority interests in television networks that evolved through mergers into positions in Warner Bros. Discovery.

Governance has transitioned to the next generation, with a focus on creative brands, subscription-led models, live events, and disciplined capital allocation across cyclical media markets.

18. Jobs Family – $22 Billion

Laurene Powell Jobs oversees the family’s wealth through Emerson Collective, a hybrid of family office and philanthropic enterprise focused on education, immigration, climate, and impact investing. She inherited major holdings in Disney after Pixar’s sale in 2006 and previously held a significant Apple stake from Steve Jobs’s estate, later diversifying the portfolio. Emerson Collective owns The Atlantic and stakes in mission-driven companies and funds. Philanthropic initiatives include the XQ Institute, targeting high school transformation.

The dynasty’s influence blends cultural assets, media, and technology with venture-style investing and program-related initiatives aimed at long-term social and environmental outcomes.

17. Hearst Family – $24.5 Billion

The Hearst dynasty controls Hearst, a diversified media and information company with magazines, local television stations, digital brands, and substantial business-to-business data assets. The company co-owns major cable networks and holds a significant minority interest in ESPN, while operating ventures in healthcare information, aviation data, and transportation analytics. Family governance runs through a trust structure, with multiple branches represented on the board. Philanthropy flows from foundations honoring William Randolph Hearst’s legacy.

Emphasis on cash-generative media properties, subscription growth, and information services has balanced legacy print headwinds, anchoring a stable, privately held portfolio across economic cycles.

16. Pritzker Family (Hyatt Hotels Dynasty) – $26.5 Billion

The Pritzker fortune originated with A. N. Pritzker and sons Jay, Robert, and Donald, expanding from industrial holdings into hospitality, manufacturing, and finance. The family created Hyatt Hotels in 1957, later taking Hyatt public while retaining significant influence. They also built the Marmon Group, most of which was sold to Berkshire Hathaway in a landmark multi-stage transaction. After a 2002 family settlement, branches pursued independent strategies.

Penny Pritzker served as U.S. Commerce Secretary and leads investment firm PSP Partners; J. B. Pritzker became governor of Illinois. Philanthropy emphasizes education, civic institutions, and entrepreneurship ecosystems worldwide.

15. Johnson Family – $38.7 Billion

The Johnson family’s fortune is anchored by Fidelity Investments, founded by Edward C. Johnson II in 1946 and expanded under Edward “Ned” Johnson III. Abigail Johnson now serves as chair and CEO, overseeing asset management, brokerage, retirement, and workplace platforms used by millions of investors. The family retains controlling influence at the privately held firm alongside significant employee ownership. Beyond finance, the dynasty supports arts, education, and biomedical research through prominent foundations.

A conservative balance sheet, fee diversification, and workplace savings flows help stabilize results across cycles, while next-generation Johnsons participate in governance and philanthropy.

14. Lauder Family – $40 Billion

The Lauder family built its fortune through Estée Lauder Companies, created by Estée and Joseph Lauder and grown by Leonard Lauder into a global beauty powerhouse. Its portfolio spans Estée Lauder, Clinique, MAC, Bobbi Brown, Too Faced, and La Mer, with strength in skincare and prestige cosmetics. Family members maintain leadership roles—William P. Lauder is the former executive chairman and now serves as Chair of the Board—while dual-class shares preserve influence.

Recent challenges in travel retail and China have been met with brand investments, supply-chain fixes, and fragrance momentum. Philanthropy includes breast-cancer research and museums, reflecting multigenerational stewardship of a venerable luxury brand.

13. Cox Family – $41 Billion

The Cox family controls Cox Enterprises, a privately held conglomerate founded by James M. Cox. Core platforms include Cox Automotive—owner of Autotrader, Kelley Blue Book, Manheim auctions, and digital wholesale tools—and Cox Communications, a major U.S. broadband provider. The company has also invested in cleantech and sustainability ventures while streamlining legacy media exposure. Governance has transitioned to the next generation, with Alex Taylor as CEO and family trustees overseeing ownership.

Disciplined capital allocation, steady subscription revenue, and scale in automotive marketplaces underpin durable cash flow, positioning the dynasty for continued growth beyond traditional media cycles.

12. Ballmer Family – $52 Billion

The Ballmer family’s wealth derives primarily from Steve Ballmer’s long Microsoft tenure and ongoing shareholdings. After serving as CEO from 2000 to 2014, he retained a major stake benefitting from the company’s cloud-driven expansion and dividends. Ballmer purchased the NBA’s Los Angeles Clippers in 2014 and backed a new arena and fan-experience technology. Through Ballmer Group, the family funds economic mobility, education, and government data modernization.

Concentrated ownership in a high-quality software franchise, combined with professional sports assets and a sizable cash portfolio, continues to drive liquidity, philanthropy, and multigenerational wealth planning.

11. Bloomberg Family – $53 Billion

The Bloomberg family’s fortune centers on Bloomberg L.P., founded by Michael R. Bloomberg in 1981. The company’s financial data terminals, news service, and trading platforms provide mission-critical information to capital markets worldwide. Michael Bloomberg remains majority owner and has pledged most of his wealth to philanthropy through Bloomberg Philanthropies, which supports public health, climate action, education, and the arts. The family maintains media assets including Bloomberg Television and radio, while expanding into indices and analytics.

A recurring subscription model, high switching costs, and distribution underpin cash flow that funds civic projects and generational giving.

10. Rockefeller Family – $63 Billion

The Rockefeller fortune originated with John D. Rockefeller’s Standard Oil, whose breakup seeded modern energy majors and substantial family trusts. Over generations, wealth diversified into real estate, venture and private-equity funds, and public securities stewarded by family offices and foundations. The dynasty’s civic footprint includes Rockefeller University, the Rockefeller Foundation, and landmarks such as Rockefeller Center (now owned by institutional investors). Branches pursue impact investing and climate initiatives while maintaining traditional portfolios.

Although no longer tied to controlling stakes in oil, the family remains a symbol of philanthropy and multigenerational governance through councils and committees.

9. Mars Family – $78 Billion

The Mars family owns Mars, Incorporated, one of the world’s largest privately held companies. Founded in 1911, Mars spans confectionery (M&M’s, Snickers), pet nutrition (Pedigree, Royal Canin), and veterinary services through Banfield, VCA, and other clinics. The family emphasizes privacy, long horizons, and professionalized management while maintaining tight control. Growth has leaned on brand stewardship, global distribution, and consolidation in pet health, which now represents a significant share of revenue.

Broad geographic reach, recession-resilient treats, and recurring vet services combine to generate durable cash flow, funding reinvestment, acquisitions, and philanthropy in animal welfare and science.

8. Buffett Family – $84 Billion

The Buffett family’s wealth is concentrated in Berkshire Hathaway, the conglomerate Warren Buffett built through insurance float, disciplined acquisitions, and long-term equity stakes. Holdings span railroads, utilities, manufacturing, housing, and consumer brands, plus large positions historically including Apple, Coca-Cola, and American Express. Philanthropic commitments—through the Giving Pledge and planned gifts to the Gates Foundation and family charities—will distribute the majority of Warren Buffett’s fortune.

Operating earnings, investment income, and cash reserves support buybacks and opportunistic deals, while family members focus on philanthropy over management. A culture of decentralization and trust underpins Berkshire’s durability across cycles.

7. Dell Family – $93 Billion

The Dell family fortune reflects Michael Dell’s founding of Dell Technologies and subsequent value creation through privatization, strategic M&A, and a return to public markets. Key steps included the 2013 take-private, the 2016 acquisition of EMC (bringing VMware), and later transactions to simplify the capital structure. Wealth is managed through MSD Capital and MSD Partners, now combined, investing in public equities, credit, private equity, and real assets. Michael Dell retains significant Dell Technologies ownership.

Exposure to enterprise infrastructure, PCs, and related software, complemented by diversified investments, supports liquidity, philanthropy, and multigenerational planning.

6. Koch Family – $99 Billion

The Koch family’s wealth is anchored by Koch Industries, steered for decades by brothers Charles and the late David Koch. The privately held conglomerate spans refining and chemicals, paper and packaging (Georgia-Pacific), fertilizers, commodities trading, and industrial technology through subsidiaries like INVISTA and Molex. Significant free cash flow fuels reinvestment, acquisitions, and multigenerational ownership via trusts. The family is also known for extensive philanthropy—medical research, higher education, arts—and for public-policy advocacy.

Diversified industrial earnings, private ownership, and disciplined capital allocation continue to generate substantial cash generation across cycles and preserve family control.

5. Gates Family – $105 Billion

The Gates family’s wealth is anchored by Bill Gates’s Microsoft stake and his private investment vehicle, Cascade Investment, which holds diversified positions in public and private companies, real estate, and hospitality. Microsoft dividends and portfolio cash flow fund large-scale philanthropy through the Gates Foundation, focused on global health, vaccines, and education. Following the 2021 divorce, Melinda French Gates established independent initiatives while the foundation’s mission continued under updated governance.

Family influence is expressed through long-horizon investing, technology-focused giving, and research partnerships, with liquidity largely driven by Microsoft’s performance and Cascade’s steady, multi-sector capital allocation.

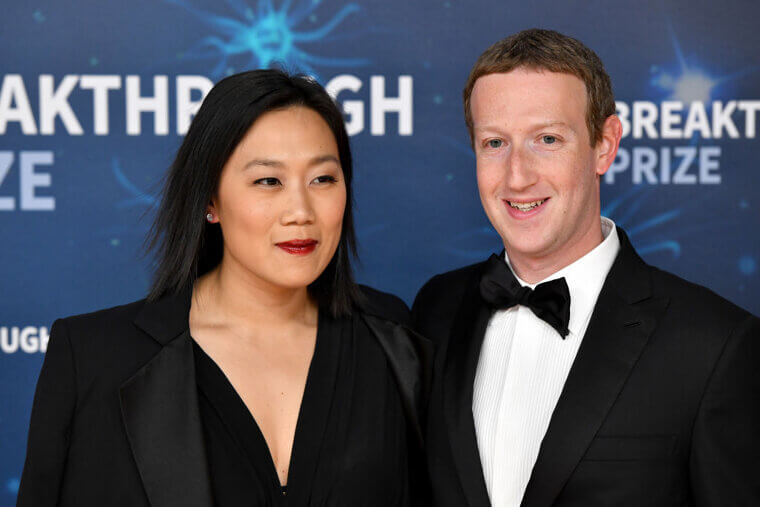

4. Zuckerberg Family – $211 Billion

The Zuckerberg family’s fortune centers on Meta Platforms, parent of Facebook, Instagram, WhatsApp, and Reality Labs. Mark Zuckerberg retains majority voting control through high-vote shares, guiding strategy across social platforms, AI, and mixed reality hardware. Strong advertising economics and scale underpin Meta’s cash generation, while long-run bets include AR/VR devices and foundational AI models deployed across products.

With physician and educator Priscilla Chan, Zuckerberg co-leads the Chan Zuckerberg Initiative, funding biomedical research (including disease mapping and tools for scientists), education technology, and community programs. Family wealth remains concentrated in Meta equity, complemented by philanthropic commitments.

3. Bezos Family – $212 Billion

The Bezos family’s wealth derives primarily from Jeff Bezos’s creation of Amazon and continued ownership of significant stock—driving liquidity through appreciation and periodic share sales. Beyond e-commerce and cloud leader Amazon Web Services, Bezos founded Blue Origin, developing reusable rockets and lunar capabilities, and owns The Washington Post. The Bezos Earth Fund directs large-scale climate philanthropy, while additional investments span space, media, and technology.

Family holdings emphasize innovation-led businesses with substantial reinvestment needs and long time horizons. Net worth remains sensitive to Amazon’s share price, partially balanced by private assets and diversified, mission-aligned philanthropy.

2. Musk Family – $336 Billion

The Musk family’s fortune is overwhelmingly tied to Elon Musk’s stakes in Tesla and SpaceX, supplemented by positions in X (formerly Twitter), xAI, Neuralink, and The Boring Company. Tesla’s market value and SpaceX’s private valuations drive most fluctuations, with liquidity events occurring via share sales and secondary offerings. Musk’s role spans electric vehicles, battery storage, launch services, satellite internet, and frontier AI—creating a portfolio exposed to technology cycles and regulatory environments.

The Musk Foundation funds science education, pediatric research, and disaster relief. Overall wealth remains concentrated and highly volatile, reflecting ambitious, capital-intensive enterprises.

1. Walton Family – $432 Billion

The Walton family’s wealth stems from Walmart, founded by Sam Walton and built into the world’s largest retailer by revenue. Heirs Rob, Jim, and Alice Walton anchor family influence, with ownership consolidated through Walton Enterprises and related trusts. Walmart’s scale in groceries, general merchandise, logistics, and private label—plus a growing advertising and e-commerce business—supports durable cash flow. The family also holds stakes in Arvest Bank and diverse investments, alongside notable philanthropy in education, arts, and community development.

Long-term governance, succession planning, and disciplined reinvestment at Walmart continue to underpin the dynasty’s exceptional, multi-generational fortune.